The Underwriting Revolution: Leveraging Alternative Data for Precision Risk and Profitability

For decades, insurance underwriting served as the prudent gatekeeper, relying on historical loss data and basic customer attributes such as age, ZIP code, credit score to determine risk. This static underwriting model was inherently backward-looking, treating thousands of unique individuals and properties as homogenized buckets of risk. This approach led to two fundamental issues: overcharging low-risk customers who eventually churn, and unknowingly subsidizing high-risk customers, resulting in margin erosion.

Today, however, the rise of ubiquitous sensors, cloud computing, and advanced AI has ushered in the Underwriting Revolution. Risk selection and pricing are no longer historical assessments, they are predictive, dynamic, and hyper-personalized. The critical catalyst for this shift is the strategic use of Alternative Data, non-traditional, real-time data streams that allow carriers to price risk with lazer sharp precision, unlocking new levels of profitability and gaining an undeniable competitive edge.

The End of the Static Risk Bucket

The modern insurance market demands that carriers move beyond Market Pricing (what the competitor charges) to true Technical Pricing (what the risk costs). Traditional data models are failing to keep pace with rapid societal and environmental change from instant shifts in driving habits captured by telematics to the escalating threat of localized flood risk captured by geospatial imagery.

The goal of modern underwriting is not just to screen out bad risks, but to reward good risks with better premiums and services, fostering unparalleled customer loyalty. Alternative Data allows underwriters to create a continuous, real-time risk profile, enabling the shift from a one-time assessment to Dynamic, Real-Time Pricing throughout the policy lifecycle.

The Three Pillars of Alternative Data

The digital world provides underwriters with rich, granular data that was unimaginable a decade ago. Leveraging this requires not just access, but expertise in interpretation and integration.

1. Geospatial and Climate Data

For Property & Casualty (P&C) insurers, the physical risk environment is everything. Geospatial data derived from satellite imagery, LiDAR scans, and public mapping APIs, allows carriers to assess hazards like flood, wildfire, and subsidence at the individual property level, not just the ZIP code level.

- Impact: Actuaries can create far more accurate models for future loss frequency and severity. For example, satellite images can verify roof condition or distance to a fire hydrant instantly, cutting the cost and time of physical inspections.

2. Telematics and IoT (Internet of Things)

In auto, health, and commercial lines, connected devices provide real-time behavioral data. Telematics data captures actual driving habits, while IoT sensors in homes or commercial properties report conditions that directly mitigate or elevate risk (e.g., water leaks, temperature fluctuations).

- Impact: This enables Usage-Based Insurance (UBI), moving risk assessment from static assumptions (e.g., driver age) to actual behavior (e.g., smooth braking, low speed). This allows immediate premium adjustments, incentivizing safer behavior and reducing portfolio risk.

3. Behavioral and Unstructured Data

GenAI and advanced Natural Language Processing (NLP) unlock value trapped in unstructured documents. This includes analyzing public records, customer interaction logs, social sentiment, and even legal claims documentation.

- Impact: In Life and Health insurance, AI can analyze complex medical records or electronic health data (with consent) instantly, accelerating application processing from weeks to minutes while flagging inconsistencies or high-risk indicators that were easily missed in manual review.

The Engine: AI/ML for Precision & Prediction

Accessing Alternative Data is only half the battle, the real value is derived from the AI/ML model that consumes it. Traditional regression models are too rigid to handle the volume, velocity, and complexity of this data. AI/ML models are necessary because they can:

- Identify Complex Correlations: Discover non-linear relationships between thousands of variables that a human actuary or a simple linear model would miss (e.g., correlating specific road types with sudden acceleration events).

- Predict Loss Frequency and Severity: Build highly accurate predictive models that assess the probability of a claim and the likely cost, providing the underwriter with a true risk score rather than a vague risk category.

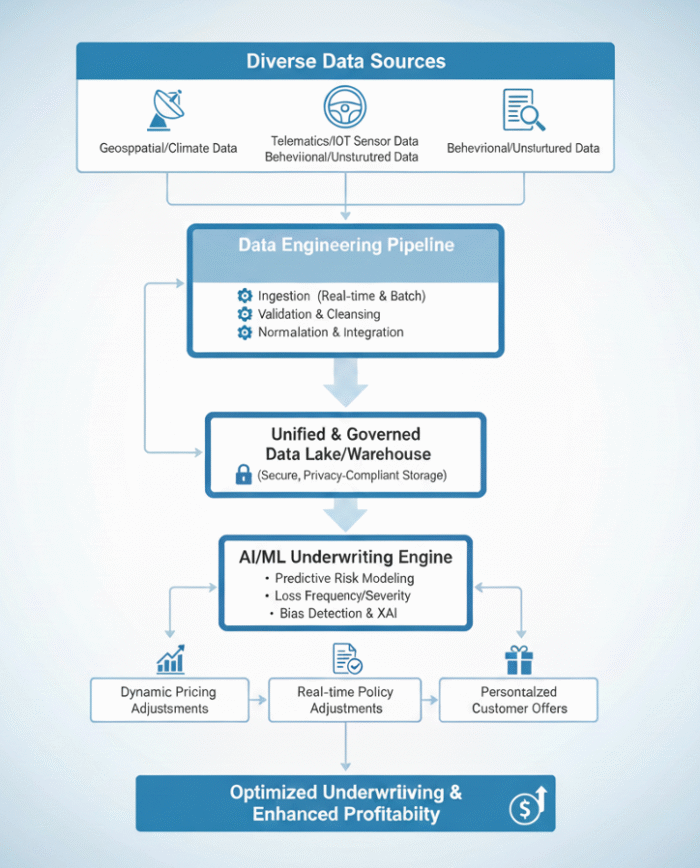

The implementation of this intelligence requires a sophisticated, highly governed process. The flow moves from raw, external data sources through a controlled pipeline to generate actionable pricing.

The Technical Challenge: Data Engineering as the Battleground

The greatest barrier to this underwriting revolution is not the lack of data or the lack of AI algorithms, but the technical integration and governance. The core challenge for every carrier is transforming a complex, messy collection of external and internal data sources into a usable, reliable resource. This is where Data Engineering becomes the ultimate battleground for competitive advantage.

Successful integration requires:

- Scalable Data Pipelines: Building robust cloud-native infrastructure to ingest petabytes of data from telematics providers, satellite feeds, and third-party aggregators in real-time.

- Data Validation and Governance: Implementing automated tools to cleanse, normalize, and validate external data for quality and consistency before feeding it into predictive models.

- Ethical AI and Privacy: Establishing governance frameworks (like XAI, Explainable AI) to ensure models are transparent, non-biased, and compliant with evolving privacy regulations (GDPR, CCPA). The technical infrastructure must be built to handle data masking and lineage tracking from the ground up.

The seamless integration shown above ensures that the carrier’s digital engineering strategy dictates the ceiling of its underwriting precision. A fragmented data landscape is a liability; a unified, governed data ecosystem is an asset that drives superior risk selection.

Is Your Underwriting Strategy Future-Ready?

The underwriting revolution transforms the function from a back-office cost control center into a strategic revenue enabler. By leveraging Alternative Data and AI/ML, carriers can move from mass-market segmentation to segments of one, allowing them to attract and retain the most profitable customers while accurately pricing out or mitigating undesirable risk. This precision drives lower loss ratios, improved customer lifetime value, and a decisive advantage in a hyper-competitive market. The journey demands a strong technology partner capable of designing and deploying the resilient data pipelines and sophisticated AI models necessary to power the next era of precision underwriting. Let’s connect to discuss how we can help you lead the underwriting transformation.

Frequently Asked Questions

-

What is Alternative Data in insurance?

Alternative Data refers to non-traditional data sources used in underwriting, such as geospatial imagery (satellite photos), telematics (driving data), IoT sensor data, and behavioral patterns, which provide real-time, granular insights beyond standard demographic information. -

How does Alternative Data improve profitability?

It improves profitability by enabling precision pricing. Carriers can accurately identify and reward low-risk customers (reducing churn) and accurately price high-risk exposures (reducing leakage and improving the loss ratio). -

What is the difference between static and dynamic pricing?

Static pricing sets the premium based on historical data and unchanging factors (e.g., age and location) for the policy term. Dynamic pricing uses real-time or continuous data (e.g., telematics score, recent claims activity in the area) to adjust the premium or risk assessment throughout the policy lifecycle. -

What is the biggest challenge in using Alternative Data?

The biggest challenge is data integration and governance. Carriers must build scalable Data Engineering pipelines to ingest, cleanse, validate, and integrate the high volume and velocity of external data into legacy core systems while ensuring data privacy and regulatory compliance. -

Is using Alternative Data ethical?

It is ethical when implemented with robust Data Governance. Insurers must ensure the data is used fairly, models are free from bias (checked via Explainable AI or XAI), and all consumer data usage adheres strictly to privacy regulations like GDPR or CCPA.