Generative AI-Powered Risk & Compliance: Redefining Trust in Modern Banking

By Anand Singh, Vice President – BFSI, Americas, PureSoftware

In today’s hyper-digital financial world, risk and compliance are no longer back-office functions, they’re central to building trust and resilience. As regulations multiply across borders and financial crime grows more sophisticated, traditional tools often fall short. Generative AI (GenAI) is emerging as the catalyst reshaping how banks anticipate risk, govern with agility, and earn stakeholder confidence.

Why this Matters Now?

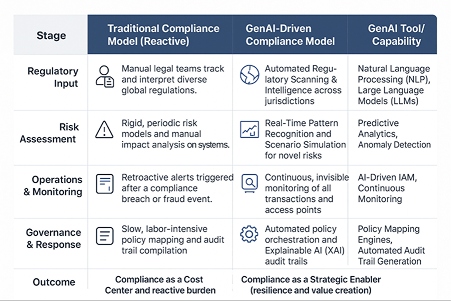

The accelerating pace and complexity of modern finance are exposing cracks in legacy compliance models. Manual reviews and rigid rule engines are increasingly unable to keep up with rapidly evolving regulatory demands and novel fraud schemes. GenAI’s emergence enables banks to transition from reactive responses to proactive, intelligence-driven governance, using real-time pattern recognition and predictive analytics to anticipate risks before they materialize.

According to a 2024 McKinsey & Company study, GenAI is fueling a transformative shift allowing leading banks to automate regulatory intelligence, streamline risk assessments, and monitor operations across jurisdictions in real time. These pressures are not just theoretical as in 2023, global institutions faced significant fines stemming from compliance lapses (Lucinity Compliance Report), making robust, future-proofed solutions more critical than ever.

How GenAI is Reshaping Compliance?

Banks are already using GenAI to automate regulatory scanning, conduct impact analyses, and map policies across disparate systems, enabling faster and more reliable responses to change. For example, major cloud providers now embed localized compliance frameworks directly into their platforms, offering automated audit trails, robust encryption, and continuous monitoring, which eases global expansion and streamlines regulatory adaptation. Modern regulatory solutions also leverage GenAI for scenario testing and simulation. This means compliance teams benefit from proactive insights rather than retroactive alerts, continually sensing, simulating, and responding to risks for shorter decision cycles and improved operational confidence.

Leading tech firms are embedding GenAI into banking compliance frameworks to accelerate detection, reporting, and governance. Microsoft combines AI-powered anomaly detection with natural language processing to tackle fraud and regulatory review at scale. Google advances model risk and explainability tools for transparent AI oversight. AWS integrates comprehensive governance and audit controls within its cloud AI services, ensuring real-time compliance monitoring. Oracle offers adaptive AI agents automating anti-money laundering scenario testing and risk mitigation, accelerating product launches. Palo Alto Networks secures GenAI use with dynamic policy enforcement and data leak prevention. Collectively, these innovations propel banks from reactive compliance toward intelligent, proactive ecosystems, future-proofed against evolving regulatory landscapes.

The Business Impact: From Cost Center to Value Creator

Recent research, including studies commissioned by Forrester, highlights that while compliance costs are rising, financial institutions increasingly recognize opportunities to evolve compliance programs into strategic enablers. By leveraging advanced technologies such as generative AI, banks can simultaneously address regulatory requirements and support sustainable growth, optimize market entry strategies, and enhance risk mitigation capabilities. This evolving perspective positions compliance not just as a cost center but as a valuable contributor to competitive resilience

Securing the Core: Redefining Identity, Access, and Financial Crime Prevention in Modern Banking

Behind this evolution, sophisticated identity and access management (IAM) systems work quietly to ensure only the right people access sensitive banking data. AI-driven platforms now automate the orchestration of employee and customer permissions, continuously adapt to changing roles and regulations, and flag irregularities, all with minimal manual intervention. This shift frees up compliance teams to focus on higher-value analysis while reducing fraud risk and audit complexity. As banks embrace hybrid operating models and more digital touchpoints, these adaptive systems serve as a ‘silent backbone’, accelerating onboarding, safeguarding user identities, and supporting seamless regulatory audits. Across leading GenAI banking deployments, this invisible, AI-enabled vigilance sustains trust and compliance at every turn.

Responsible GenAI for Sustainable Advantage

GenAI’s rise demands stronger accountability and governance. Modern compliance blends explainable AI, human oversight, continuous monitoring, and built-in data privacy. Oracle’s GenAI automates ESG data analysis and reporting, helping banks meet rising sustainability standards with transparent, AI-powered insights. Through secure cloud-native APIs and analytics, banks shift from reactive compliance to proactive, value-focused ecosystems built for the future.

The Road Ahead

GenAI is not just optimizing compliance but redefining its value in a digital-first world. Financial institutions moving swiftly with focused pilots and robust governance will set industry benchmarks, while those who hesitate may struggle to keep pace as compliance transforms from a reactive burden to a strategic enabler. In this new landscape, risk and compliance are quietly powered by intelligent, adaptive solutions, empowering banks to thrive on trust, resilience, and growth.

As GenAI transforms compliance into a strategic asset, PureSoftware is helping BFSI firms unlock real value. From building AI-driven SME search platforms for underwriting precision to deploying intelligent GenAI chatbots for financial intelligence support, PureSoftware empowers organizations to innovate and thrive. Discover how these tailored AI solutions can accelerate your compliance and customer experience journeys.

Connect with PureSoftware BFSI experts to start your transformation.

Frequently Asked Questions

-

How is Generative AI transforming risk and compliance in banking?

GenAI is shifting banking compliance from manual, rule-based checks to predictive intelligence, enabling real-time risk detection, automated regulatory monitoring, and proactive governance across jurisdictions. -

Why is GenAI critical for the future of banking compliance?

With regulatory frameworks evolving rapidly and fraud schemes becoming more complex, GenAI provides the speed, scalability, and adaptability traditional systems lack, making it essential for building trust in digital-first banking. -

What are the top use cases of GenAI in banking compliance?

Key applications include regulatory change management, fraud and anti-money laundering (AML) detection, and real-time risk reporting with explainable audit trails for regulators and stakeholders. -

What business value does GenAI deliver in compliance functions?

GenAI can reduce compliance costs, accelerate product launches, improve risk avoidance, and boost regulatory performance, turning compliance from a cost center into a strategic growth enabler. -

How can banks ensure responsible GenAI adoption in compliance?

Banks should implement governance frameworks focusing on explainability, bias detection, continuous model monitoring, and strict data security to align with ethical and regulatory expectations. -

What steps can financial institutions take to begin GenAI adoption?

Start with focused GenAI pilots in high-impact areas like fraud detection or regulatory scanning, then scale toward an enterprise-wide risk intelligence framework supported by AI governance and specialized talent.