Driving Access, Fuelling Growth: The Real Impact of Digital Lending in Emerging Markets

By Gunjan Dhingra, Business Head – Africa, PureSoftware

Reimagining Lending for the Digitally Connected Economy

Credit offers a lifeline to economic growth — but for millions across emerging markets, access to timely, affordable credit remains out of reach. Traditional lending models, burdened by legacy infrastructure, paperwork, and manual underwriting, result in credit options that often exclude those who need it most.

At Arttha, we’ve set out to change this. By reimagining lending through a digital and AI-first lens, we’re empowering financial institutions reach underserved populations with agility, transparency, and trust. Our recent win at the IBSi Digital Banking Awards 2025 for Regional Winner – Africa stands as a powerful validation of that mission.

The Shift to Digital-First Lending: Trends Reshaping the Landscape

Emerging markets are witnessing a rapid pivot in lending strategies, driven by mobile penetration, fintech partnerships, and real-time data.

Key trends include:

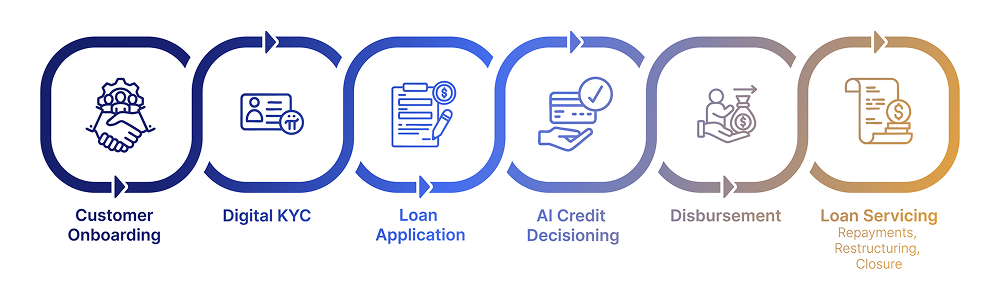

- End-to-end digital loan origination: Instant onboarding, digital KYC with options of KYC light, and automated document collection streamline customer journeys.

- AI-powered credit decisioning: Advanced risk scoring models based on alternative data (like mobile usage and utility payments) enable better credit access.

- Embedded lending models: Credit at the point of need — whether in wallets, marketplaces, or agri platforms — is redefining convenience.

- Scalable loan servicing: Cloud-native platforms are helping institutions manage disbursement, repayments, restructuring, and closure seamlessly.

These innovations are making credit not just more accessible, but also more responsive to real-world customer needs.

Challenges That Still Need Solving

Despite the promise, digital lending in underserved regions comes with its own set of challenges:

- Lack of reliable credit history in thin-file or first-time borrowers

- Data fragmentation across systems and sources

- Limited financial literacy, which can affect repayment behaviour

- Regulatory compliance complexity across geographies

What’s needed is a unified, flexible, and intelligent platform that can solve for both innovation and compliance, Arttha is purpose-built to deliver this objective.

IBSi-Winning Implementation with EcoCash: A New Benchmark for Lending in Africa

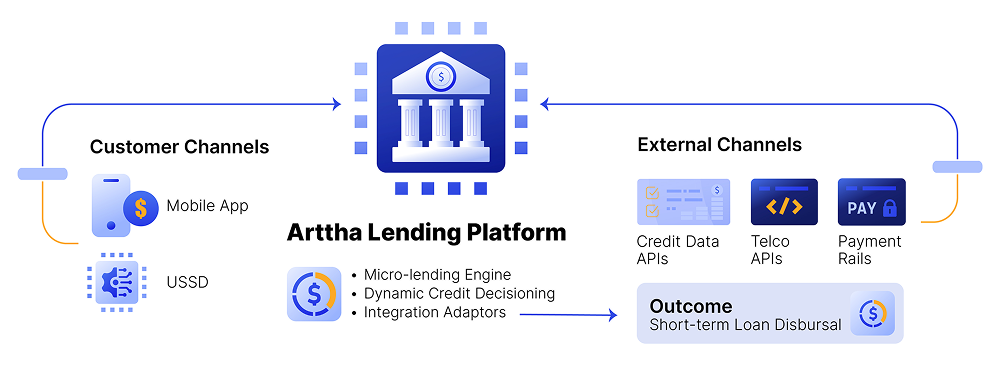

In collaboration with EcoCash, one of Africa’s leading mobile money and micro-financing providers, Arttha deployed a comprehensive digital lending platform to enable seamless credit access for millions of users.

Core capabilities delivered:

- Micro-lending solution provided the capability to configure various loan products, slab-based charges, repayment methods, amortization rules etc.

- The system provided an in-house dynamic credit decisioning engine to easily calculate the credit score of the customers based on pre-defined parameters.

- In built integration adaptors facilitated seamless integration with mobile app, USSD channels, and other external systems to provide the short-term loans to the customers.

“The recognition at the IBSi Digital Banking Awards 2025 reinforces our belief that when technology is grounded in local realities, it can bridge even the deepest access gaps. With EcoCash, we weren’t just enabling digital lending—we were driving financial progress for millions.”

The results speak for themselves:

- Demonstrated strong adoption with over 1.2 million customers onboarded and approximately 300,000 loans processed to date.

- Achieved rapid implementation within 2 months, ensuring quick value realization for both business and customers.

- Contributed to improved CSAT, increased customer base, and reduced loan disbursal time, aligning with EcoCash’s vision of driving financial inclusion and customer-centric innovation.

Looking Ahead: The Future of Lending Is Embedded, Intelligent, and Inclusive

The next wave of lending in emerging economies will be:

- Context-aware and embedded: Credit at the point of transaction — inside digital wallets, ecommerce platforms, and even utility apps

- AI-augmented underwriting: Deep learning models that adapt to borrower behaviour in real time

- Regulatory-aligned, modular platforms: Customizable for different geographies while ensuring compliance and reporting

- Partnership-driven: Ecosystem models that bring banks, telcos, and fintechs together to scale reach

At Arttha, we are investing in these capabilities — not just to deliver features, but to build impact-first platforms that drive long-term value.

Conclusion: Lending That Builds More Than Credit Scores

Digital lending isn’t just about disbursing funds faster — it’s about building a more equitable financial system where everyone can grow. From micro-entrepreneurs and farmers to gig workers and salaried employees — inclusive credit can be a catalyst for real progress.

At Arttha, we’re proud to be shaping this change. Our award-winning work with EcoCash is a blueprint for what’s possible when technology, insight, and purpose come together.

Let’s build the future of inclusive credit — one loan, one life at a time.