Beyond Transactions: The Real Power of Digital Wallets in Emerging Markets

By Gunjan Dhingra, Business Head – Africa, PureSoftware

Digital Wallets: More Than Just a Payment Tool

Across emerging markets, digital wallets have emerged as more than just a way to send or receive money, they’ve become instruments of empowerment. In regions where traditional banking infrastructure is either limited or inaccessible, wallets are transforming how individuals interact with financial services, offering a gateway to inclusion, control, and upward mobility.

At PureSoftware, through our flagship digital banking platform, Arttha, we see digital wallets as a bridge between legacy systems and tomorrow’s financial ecosystems. They are reshaping how governments distribute benefits, how merchants accept payments, and how everyday users gain access to micro-loans, savings, and even healthcare services.

Our journey — including our recent recognition at the IBSi Digital Banking Awards 2025 reaffirms that when designed with purpose, digital wallets can drive profound impact at scale.

2025 Key Trends Driving Digital Wallet Adoption in Emerging Markets

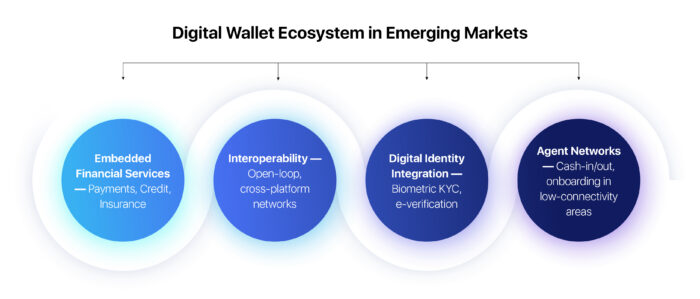

As mobile-first behaviour grows, several trends are fuelling digital wallet adoption across underserved regions:

- Embedded financial services: Wallets are evolving into platforms that bundle payments, credit, and insurance — all within a single app.

- Interoperability: The move from closed-loop systems to open-loop, interoperable networks is making wallets more versatile and inclusive.

- Digital identity integration: Biometric KYC, national ID linkages, and e-verification are boosting security and user confidence.

- Agent-based networks: Wallets are expanding beyond smartphones via agent-assisted onboarding and cash-in/cash-out services in low-connectivity zones.

These trends underscore one truth: digital wallets are not just fintech solutions — they are lifelines for the unbanked and underbanked communities.

Persistent Challenges That Require Industry Collaboration

Despite encouraging progress, gaps remain that hinder universal access and impact:

- Limited digital literacy, especially in rural populations

- Connectivity and smartphone access challenges in last-mile regions

- Trust and security concerns that prevent first-time users from adopting digital tools

- Regulatory fragmentation, which impedes cross-border innovation

Solving these requires a united effort between banks, fintechs, regulators, and development partners — with a shared vision for inclusive finance.

Arttha’s Award-Winning Digital Wallet: A Case of Real Impact

One of our recent wins at the IBSi Digital Banking Awards 2025 (Functional Area Winner – Digital Wallet) is not just a celebration — it’s a case study in how impact at scale can be achieved.

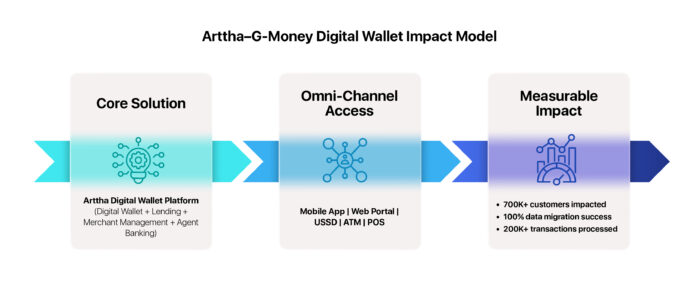

In partnership with G-Money Financial Services (a fully owned subsidiary of Ghana Commercial Bank, Africa), we implemented Arttha’s Digital Wallet platform to address critical challenges in financial access. The goal was clear: build a mobile-first solution that could empower millions of customers to lead better lives and have greater financial access.

Key highlights of the implementation included:

- The solution enabled the bank to launch converged offering of Digital wallet, Digital Lending, Merchant Management and Agent Banking for the customers in Ghana.

- The omni channel solution enabled the bank to provide their services using multiple different channels i.e., mobile app, web portal, USSD, ATM, POS, etc. catering to smartphone as well as feature phone users.

- The architecture of the product further enabled opening the offerings to fintechs and marketplaces.

“The recognition at the IBSi Digital Banking Awards 2025 reaffirms our commitment to driving meaningful digital transformation through inclusive innovation. With Arttha’s Digital Wallet Platform, we’re not just delivering technology—we’re creating pathways to financial dignity, one transaction at a time.”

The outcome?

- More than 700k+ customers life impacted

- 100% success rate in data migration

- Significant increase in digital payments powered by 200k+ transaction volumes

This is the power of digital wallets — not just enabling transactions but driving transformation.

Looking Ahead: The Future of Wallet-Driven Innovation

The future of digital wallets lies in contextual, intelligent, and connected finance. Some of the directions we are focused on at Arttha include:

- Wallets as super apps: Housing not just financial products but also services like insurance, e-commerce, and digital ID management.

- CBDC-ready wallets: Preparing for central bank digital currency integration and cross-border wallet interlinking.

- AI-powered personalization: Recommending savings tools, credit options, and transaction insights tailored to user behavior.

- Financial inclusion through partnerships: Collaborating with telcos, governments, and MFIs to expand reach and relevance.

Conclusion: Impact Begins with Purposeful Innovation

Digital wallets are more than products — they are platforms for equity, access, and innovation. In emerging markets, their potential is unmatched, but the path forward requires shared responsibility.

At Arttha, we’re committed to powering this shift — not just by providing technology, but by building ecosystems that empower people. Our IBSi recognition is a milestone, but the journey continues.

Let’s shape the future of digital finance together — from use case to lasting impact.

Frequently Asked Questions

-

What makes digital wallets so important in emerging markets?

Digital wallets provide accessible, low-cost financial services to unbanked and underbanked populations. They enable seamless payments, savings, and micro-credit, driving financial inclusion and empowering local economies. -

How does Arttha’s digital wallet platform stand out?

Arttha’s digital wallet platform supports omni-channel access, interoperability, and embedded financial services such as lending and merchant management—helping banks and fintechs deliver impactful digital experiences at scale. -

What trends are shaping the future of digital wallets?

Key trends include the rise of super apps, AI-powered personalization, CBDC-ready wallets, and stronger partnerships between banks, fintechs, and telcos to expand financial reach and innovation.