BaaS: Doorway for Banks to succeed in Banking 4.X

Banks are facing a choice between aligning their services to customer expectations or putting themselves at the risk of losing customers altogether. Business leaders in the banking industry have been discussing disruptive technology for many years, with some of them already underway on the digital transformation journey. COVID-19 pandemic has further accelerated this adoption of digital banking ways and advanced technologies in the banking space.

Several banks are substantially accelerating efforts and have embarked on their digitalization and costs optimization journey. Additionally, the banking customers affected by pandemic-driven realities now expect fully digitalized, on-demand experiences, hyper-personalized offerings and 24×7 assistance. The continuously evolving digital economy has also prompted businesses, merchants, and consumers to change how they interact to cater to the accelerated demand for tailored and frictionless banking experiences.

The evolving banking space has emerged as an opportunity for non-financial companies to venture into the banking space by embracing Banking-as-a-Service (BaaS). On the other hand, traditional banks are also considering BaaS to attract new customers and offer a greater range of services to existing clients. Thus, BaaS is increasingly seen to complement banks’ core businesses. As BaaS promises a fast and effective route to market for financial services products embedded in digital channels, its adoption is expected to grow going further.

BaaS – Value Proposition

Embedded finance is no longer the future, as the pandemic highlighted the need for banks and financial institutions to deliver new products and offerings faster than before. BaaS, being deployed quickly and efficiently, can enable banks and financial institutions to execute new business models and provide tailored products and services to the end consumer.

Here are two keyways in which BaaS can benefit banks:

New value for Incumbent Banks

New value for Incumbent Banks

Existing banks can unlock new value in open ecosystems through BaaS platforms, which give access to new data sources and monetization opportunities. Banks must follow experience-driven, platform-based approaches to embed financial services within consumer lifestyles in this rapidly evolving market. BaaS enables incumbent banks to easily tap into various external providers to strengthen their offerings and better cater to the shifting customer demands for a holistic, more integrated, and customized experience.

Secure long-term growth for banks

Secure long-term growth for banks

As banking enters an era where financial services are embedded into customers’ daily lives, better collaboration is the route to success for banks. BaaS gives unprecedented opportunities to banks to gather data through open ecosystems. Existing banks need to build digital capabilities to harvest data ecosystems to create, retain, and drive their value in the Banking 4.X era.

What is Banking 4.X

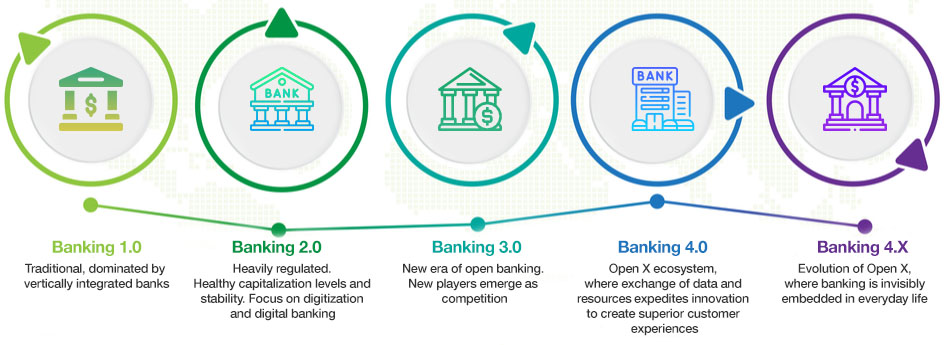

The banking industry is evolving rapidly and has led to the emergence of Banking 4.X, an experience-driven, platform-based, optimum channel banking that is resilient to unpredictable threats. Banking 4.X is built around long-term, sustainable growth where human interactions evolve from servicing to advising. In Banking 4.X, we will witness customer insights driven hyper-personalized engagements.

Road to Banking 4.X

Banking 4.X: Necessitating BaaS adoption for banks and financial institutions

Banking 4.X: Necessitating BaaS adoption for banks and financial institutions

To thrive in Banking 4.X, banks must adopt digital ways of banking and implement cloud-based BaaS platform models. These platforms leverage APIs (application programming interface) to embed banking in everyday life, making products and services more accessible and inclusive for banking customers.

By moving over outdated legacy mindsets and adopting BaaS, banks and financial institutions can move beyond their core banking products, create customized offerings, and delight their customers with personalized baking experiences. Banks must focus on adding value to their offerings to retain and engage customers. By leveraging data and through platformification, banks can delight customers with desired banking experiences and create new revenue streams.

End Notes

End Notes

The future of banking relies on a robust digital foundation and a flexible attitude toward embracing innovation. If you are looking forward to adopting banking as a service model to expand your offerings and grow, Arttha can be your route to success in Banking 4.X and beyond. Arttha is an award-winning Fintech Platform that helps banks drive revenue with powerful value propositions, such as Digital Bank in a Box, Agent Banking, Merchant Management, Loan Lifecycle Management, and Digital Wallet and Payments solutions. Connect with us to learn more.